The Best Strategy To Use For Mortgage Broker

Wiki Article

Getting My Mortgage Broker To Work

Table of ContentsExamine This Report on Mortgage BrokerFascination About Mortgage BrokerAbout Mortgage BrokerOur Mortgage Broker DiariesExamine This Report on Mortgage BrokerThe Main Principles Of Mortgage Broker More About Mortgage Broker

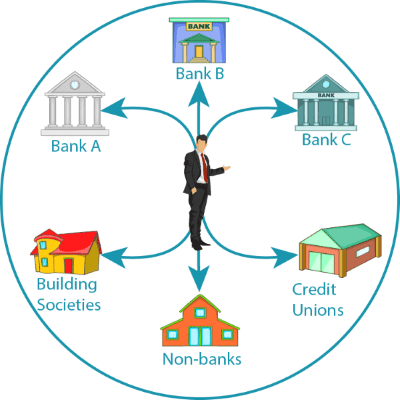

What Is a Mortgage Broker? The mortgage broker will function with both parties to obtain the specific authorized for the finance.A mortgage broker usually collaborates with numerous various lenders as well as can use a selection of finance choices to the borrower they work with. What Does a Mortgage Broker Do? A home mortgage broker aims to finish genuine estate transactions as a third-party intermediary in between a consumer and a loan provider. The broker will accumulate details from the private as well as most likely to multiple lending institutions in order to find the very best potential loan for their client.

The Base Line: Do I Required A Home Mortgage Broker? Dealing with a home loan broker can conserve the borrower effort and time throughout the application procedure, as well as possibly a great deal of money over the life of the car loan. Additionally, some lending institutions work specifically with mortgage brokers, indicating that debtors would certainly have accessibility to lendings that would certainly or else not be available to them.

The Mortgage Broker PDFs

It's vital to check out all the fees, both those you may need to pay the broker, along with any kind of costs the broker can aid you avoid, when weighing the choice to deal with a home mortgage broker.the home mortgage market can be confusing, and also points can change quickly as rates of interest fluctuate as well as mortgage deals come as well as go. mortgage broker. Having a professional who can clarify points clearly and also recognizes best technique can be vital. Disadvantages home mortgage brokers aren't constantly totally free as well as can include in your costs each time when you're trying to conserve as much money as feasible.

not all brokers will have accessibility to the entire mortgage market, suggesting counting entirely on a broker can restrict your options. Some brokers may choose particular lenders if they have great relationship with them. You can as well as must always ask a broker the amount of lending institutions they function with and also if they like any type of particular lenders.

Not known Details About Mortgage Broker

As you might anticipate, mortgage broker fees will vary from broker to broker and are influenced by a variety of variables, such as just how much you desire to borrow. The average cost for a mortgage broker is around 500 *, however various brokers can bill in different ways: the broker will establish a repaired fee to find and also organize a home mortgage for you (which you must constantly agree in writing prior to involving them).

When you purchase a home, especially if you're doing it for the initial time, you do not want it to be a hassle. So you believe to on your own: Just how can I make this as simple as feasible? I believed the same thing when I acquired a residence in 2016. It had not been my very first time buying-- I would certainly owned a home prior to with my ex-husband.

The Buzz on Mortgage Broker

What Mortgage Brokers Do If you've never acquired a house before, you may not understand what home mortgage brokers are all about. Below's the deal: To do that, you need to provide the broker particular details, including: Approval to examine your credit score records and credit history A copy of your most recent tax obligation return Recent pay stubs Your employer's get in touch with details so they can verify your work background That appears simple sufficient? As well as in exchange for providing the broker those details, they take care of all the lifting of home loan buying.You don't need to spend hrs seeking a lending because the broker is dealing with that. Mortgage brokers' obligations Mortgage brokers have professional expertise as well as sources the ordinary house purchaser doesn't. They usually have a bigger network of lending institutions they collaborate with so they can really drill to what kinds of loans you're most likely to qualify for and also what interest rate you're most likely to get.

That's all to the great due to the fact that the reduced your rate, the reduced the overall expense of borrowing finishes up being. And also aside from all that, the home mortgage broker cares for interacting with the home loan lending institution once you pick a loan. You provide the broker all the paperwork and info the lending institution needs for underwriting.

Some Ideas on Mortgage Broker You Need To Know

Ideally, all you have to do is address any type of follow-up inquiries the lender guides to the broker. Reveal up at shutting to gather the secrets to your new house. The price of making use of a home mortgage broker In return for doing all that,. The purchaser or the lending institution can pay this.By doing this, you pay nothing out of pocket. Every one of that appeared fantastic to me when I was prepared to purchase once more. I was servicing expanding my freelancing organization as well as raising two children and also I simply really did not have time to get bogged down in the information of locating a home mortgage.

He asked me to authorize off on an electronic form offering him permission to inspect my credit history - mortgage broker. I agreed and a pair of hrs later, he returned with some first price quotes for a few different types of loans (FHA, traditional and USDA). From there, I moved on to the next action: getting pre-approved.

Mortgage Broker Things To Know Before You Get This

Which I did. By the time the broker got clued in and allow me know, I would certainly currently filled out the full home loan application for the finance, with the tough inquiries on my credit scores report to verify it. This is about a month right into working with the broker. While I was a little annoyed, I asked for the next alternative, which was an FHA car loan.

(As well as I'm refraining from doing this online either-- I needed to fill up out paper applications and pay to have them Fed, Exed to the broker over night.) Given that a month had visit this site actually gone by from my last time using, I additionally had to go back and also obtain new duplicates of all my financial institution and also economic declarations.

Mortgage Broker Can Be Fun For Anyone

I repeatedly had to email copies of my pest, septic and also home examination records due to the fact that the broker kept shedding track of them. I had to pay to submit a copy of my splitting up agreement with my regional registrar's office due to the fact that the broker informed me I needed to-- only to discover out later on the lending institution really did not care anything concerning it.Report this wiki page